“When our research indicated that 50% of people had heard of Showmax, then we knew we had “saturated” the market in terms of awareness, and could effectively move into performance marketing from there.” – Barron Ernst, Zenly Senior Product Manager

How much growth is left in your market? Are the markets that you’re in saturated?

The more prospects are aware of your product and your competitors’ products, the more competitive acquisition strategies tend to be.

Since your product is viewed as one option within a set, it needs to be differentiated if it is to stand out.

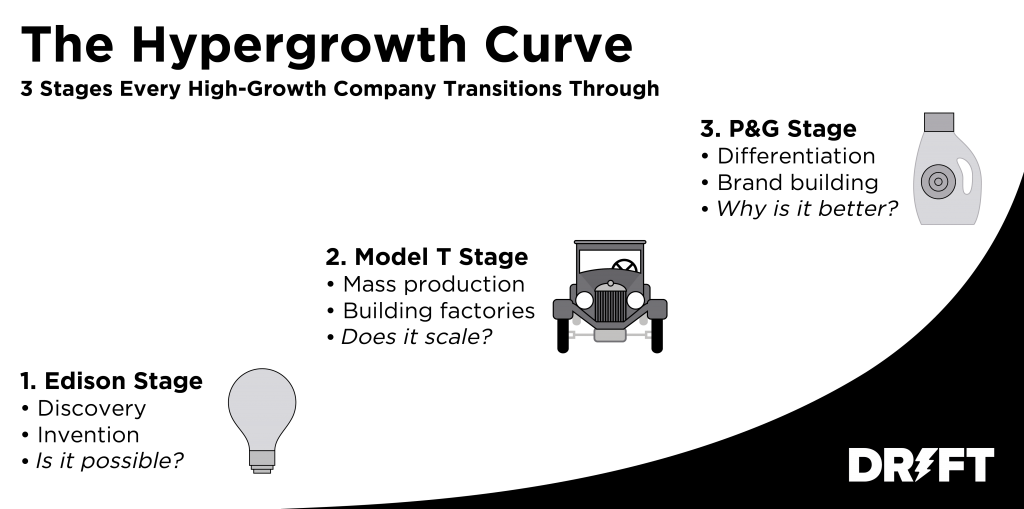

David Cancel calls this the Procter & Gamble stage. At this stage, companies need to focus on brand building and differentiation to gain market shares.

To understand where you stand, it’s a good idea to assess how much growth is left in the market. Are there still unaware prospects? Should you focus on getting customers to switch from the competition?

How to Measure Brand Awareness

To work out what proportion of the prospect pool is aware of your brand, start by sizing your target market. How many customers are there? How many of those customers are your customers?

If you can find your competitors’ customer count—perhaps through their annual reports, S-1 filings, or fundraising announcements—then you can begin to get a feel for how much opportunity is left in the market.

Taking this a step further, you can create an anonymous survey asking prospects within the market which products they have heard of.

“Which of the following products have you heard of?”

By listing the top 10-12 options on the market, and ordering them randomly, you’ll be get good data on brand awareness in your market.

For each positive response, ask a follow up question:

“What do you understand [ Product ] does?”

The answers will help reveal the messages shared on the market.

Is your positioning clear? How different are your competitors’ positionings? How many prospects surveyed know none of the products on the market?

Analyzing the Results

For this type of research to be effective, recruit randomly in your target market. Respondents can include your customers, your competitors’ customers, and prospects who are not yet aware of your brand or your competitors’ brands.

400 respondents should start giving you reliable data. If your market has less than a few thousand prospects, then don’t waste your time. Your sales team or your CRM should be able to tell you which prospects have heard of your organization.

To get more than 400 respondents and avoid associations with your brand, the survey should either be done Off-Brand, or conducted through a market research agency. These agencies will help incentivize participants and will make sure you get a large enough sample size.

If you intend to do your own recruitment, avoid any affiliations with your organization and focus your efforts on the market’s watering holes.

You can consider market awareness saturated when 50% or more of prospects are aware of your product or your competitors’ products.

Above 50%, focus your messaging on differentiation. Under 50%, focus on awareness. It all starts when you measure brand awareness.

– –

This post in an excerpt from Solving Product. If you enjoyed the content, you'll love the new book. You can download the first 3 chapters here →.